Minor in Actuarial Science

Inclement Weather: February 25, 2026

All classes starting prior to 11 a.m. will be remote. Classes after 11 a.m. will be in person. Non-essential staff should work remote until 11 a.m. then report to campus as scheduled.

A natural complement to many business majors, the actuarial science minor is particularly suited to those interested in applying their knowledge of mathematics, probability, statistics, economics and more.

What is Actuarial Science?

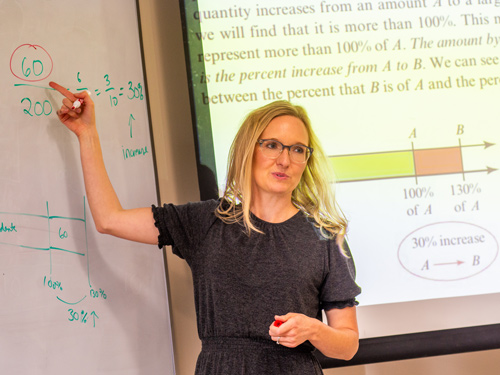

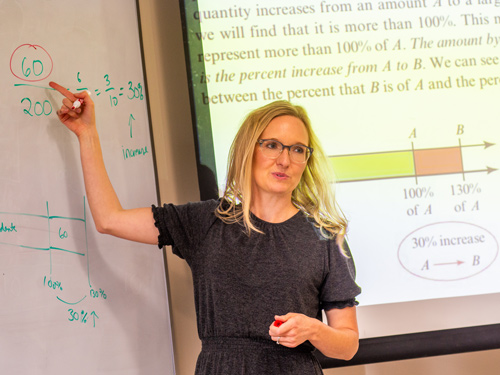

Actuarial science is a discipline that applies mathematical and statistical ingenuity in order to assess risk, most commonly in insurance and finance. It has gone through revolutionary changes since the growth of high speed computing and demand for financial theory. An actuary is expected to be diverse in knowledge that includes mathematics, probability, statistics, finance, economics, and computer programming.

Why Earn Your Actuarial Science Minor at Sacred Heart?

Actuarial science is a discipline that applies mathematical and statistical ingenuity to assess risk, most commonly in insurance and finance. The actuarial science minor at Sacred Heart University complements business majors, particularly finance majors.

Where Can I Learn More about Actuarial Science?

Visit www.soa.org to learn from the Society of Actuaries.

Who Can Earn an Actuarial Science Minor?

Although other majors are welcome, this minor requires only a few extra courses beyond the finance major. Anyone interested in the actuarial program should visit the mathematics or finance departments for information.

You can declare a minor at any time, but it is always advisable to declare a minor sooner rather than later.

Required Courses | 24 Credits

Emphasis on the information that the language of business provides for decisionmakers. This is accomplished by using a transactions-analysis approach. Individual and team-based problems and cases are used to stress accounting fundamentals as well as the global and ethical issues of accounting decisions.

Provides an overview of the principles and techniques used in financial management and an introduction to financial markets. Topics include time value of money, measures of risk, models for pricing bonds and stocks, financial analysis, capital structure, cost of capital, capital budgeting, and working capital management. Students are introduced to financial problem-solving using Microsoft Excel.

Prerequisite: Take AC 221

Designed to help undergraduate students understand the basic derivative markets such as forward, futures, options, and swap markets. Key concepts needed to price these basic claims, such as the law of one price, the cash and carry arbitrage, and the put call parity, are introduced and explained. Explores the pricing of these claims, as well as arbitrage and hedging in these markets.

Prerequisite: Pre: FN-315

Explores limits and approximation, differential and integral calculus of the elementary algebraic and transcendental functions, and applications of differentiation and integration.

Prerequisite: Minimum grade of C in MA-140 or placement by Dpt

Covers applications and methods of integration, inverse trigonometric functions, improper integrals, sequences and series, parametric representation, and polar coordinates.

Prerequisite: Take MA-151 with a minimum grade of C, P

Focuses on matrix theory, systems of linear equations, linear transformations, vector spaces and subspaces, determinants, eigenvalues, inner product spaces, and orthogonality.

Prerequisite: MA-152 with a minimum grade of C, P

Addresses probability, discrete random variables and their distributions, mathematical expectations, sampling distributions, and multivariate distributions. Offered every Third Semester.

Prerequisite: Math-152 with a minimum grade of C, P

This course covers the fundamentals of financial valuation and pricing of Life and Annuity contracts as covered in the Joint Society of Actuaries/Casualty Actuarial Society FM exam and the Life Contingencies portion of the Society of Actuaries FAM exam. This includes the Theory of Interest; valuation of loans, annuities, and bonds; the term structure of interest rates, rates of return and attribution of investment income. The Life Contingencies section adds mortality and survival to these financial computations including computation of Life Insurance and Annuity benefits, premiums, and valuation.

Prerequisite: Take MA-331 and FN-215 with a Minimum Grade of C

Although not required for this minor, it is recommended that you take MA 332 Mathematical Statistics. If majoring in math, students should choose EC 202 and EC 203 for their required supporting courses. If majoring in Finance, EC 202 and EC 203 are mandatory.

About Actuary Exams

In order to become an actuary, preliminary exams must be passed. Different types of actuaries will take specialized exams to their specific field, however, the preliminary exams are the same. A successful completion of as many of these exams as an undergraduate is most helpful. Here at Sacred Heart University we offer courses that help you with the probability exam, the financial mathematics exam, and the models for life contingencies exam. Once a student enters the work force, most employers will provide study time for exams, will pay exam fees, and provide promotions for passing the exams.

More Information

The Latest in Mathematics

View More News-

Academics, Speakers & EventsPublished:New England mathematics community comes together at SHU for talks, breakout sessions and anniversary events

Academics, Speakers & EventsPublished:New England mathematics community comes together at SHU for talks, breakout sessions and anniversary events -

Universal Design

Academics, Advancing SHU, Faculty & Staff SpotlightPublished:Faculty members use grant to improve math teaching skills, curriculum design and access to learning. -

Teachers Share Experiences in Peer-Reviewed Magazine

Academics, Faculty & Staff SpotlightPublished:Professors collaborate on how to prepare math teachers in SHU program